When Housing Affordability Meets Insurance Affordability

A Total Cost of Risk Framework for Regional Housing Authorities in Southeastern Massachusetts

The insurance crisis and the affordable housing crisis are not parallel problems—they are the same problem viewed from different angles. When communities fail to address them together, they accelerate both. Nowhere is this more evident than in southeastern Massachusetts, where a combination of coastal flood exposure, aging manufactured housing stock, and significant affordable housing needs creates both urgent challenges and opportunities for innovation.

This article proposes a pilot framework for regional housing authorities to integrate insurability planning into affordable housing preservation and development. By applying a Total Cost of Risk (TCOR) approach across multiple jurisdictions, housing authorities can protect vulnerable residents, preserve housing stock, and demonstrate models that scale beyond any single community.

The Compounding Crisis

Low-income households face the highest physical exposures to climate hazards while having the least capacity to absorb insurance costs. Research from Headwaters Economics demonstrates that one in seven mobile homes is located in an area with high flood risk, compared to one in ten for all other housing types. The disparity in insurance coverage is even starker: according to FEMA, fewer than 1% of manufactured housing residents have flood insurance.

In Southeastern MA, these national patterns intersect with specific local conditions. Plymouth county’s 14+ manufactured home communities, combined with affordable rental portfolios managed by local housing authorities and Community Development Corporations, represent critical housing stock serving residents who cannot simply relocate when insurance becomes unavailable or unaffordable. When this housing goes uninsured or underinsured, the costs don’t disappear—they shift to residents (through uncompensated losses), municipalities (through emergency services and lost tax revenue), and ultimately to all taxpayers (through disaster relief).

The racial and economic dimensions of this crisis deserve explicit attention. Manufactured housing communities and affordable housing developments are disproportionately home to lower-income households, seniors on fixed incomes, and communities of color. These populations have historically been sited in flood-prone areas through discriminatory zoning and land use practices. Insurance market failures compound these historical inequities, creating a protection gap that falls heaviest on those least able to absorb it.

Why a Regional Approach?

Individual municipalities lack the risk pool size, technical capacity, and political leverage to solve insurability challenges alone. A 50-unit manufactured home community in Kingston or a 30-unit affordable rental property in Marshfield cannot, by itself, attract MGA innovation or achieve meaningful risk pooling. But Plymouth County’s or greater southeastern MA affordable housing portfolio—spanning multiple housing authorities, CDCs, and manufactured home communities—creates the scale necessary for embedded insurance solutions to become viable.

A county-level or multi-jurisdictional approach offers several advantages:

• Risk pooling: Aggregating diverse housing typologies across multiple communities creates a larger, more diversified risk pool that can achieve better pricing than any single property or community.

• Technical capacity: Regional coordination allows shared investment in TCOR analysis, MGA relationships, and program administration that individual small municipalities couldn’t sustain.

• Innovation attraction: MGAs and insurance innovators need sufficient market size to justify product development investment. A regional affordable housing portfolio provides that market.

• Replication pathway: Success in pilot regions creates a documented model that other regions facing similar challenges can adapt. This provides spread of risk and other economies of scale that can support more affordable and accessible risk transfer.

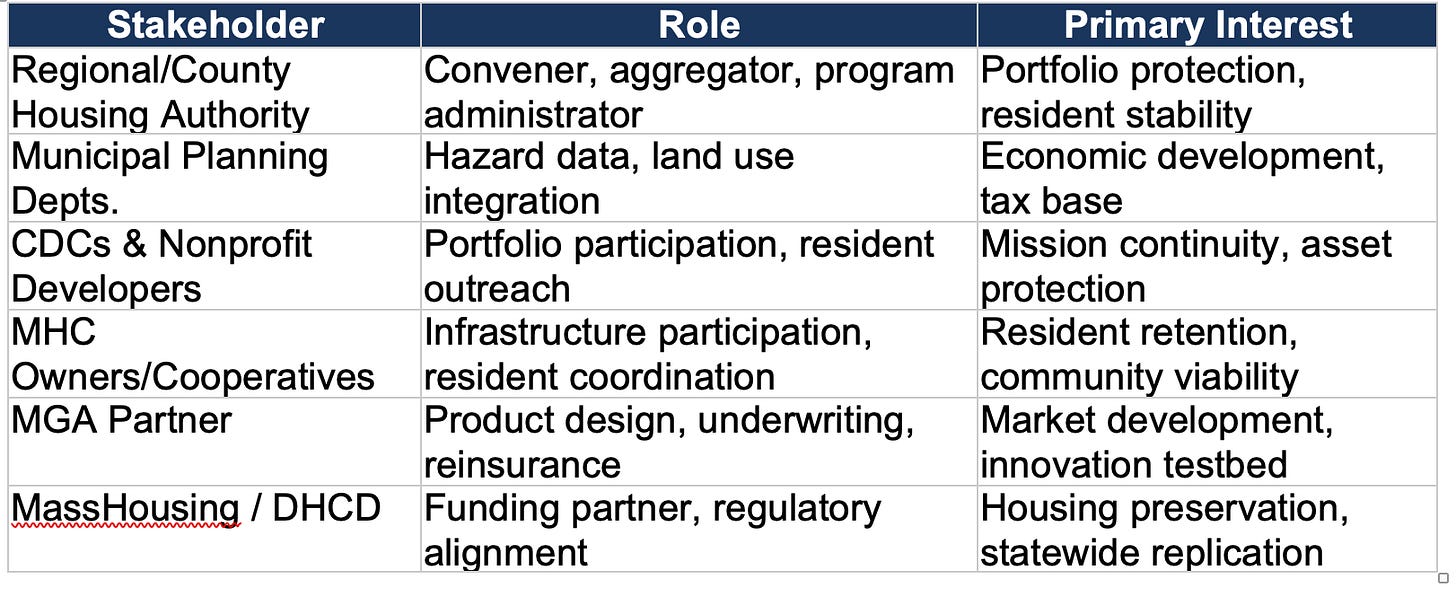

Key Stakeholders for a Pilot

Housing Typologies and Insurance Challenges

A regional pilot could address three distinct housing typologies, each with unique insurance challenges and embedding opportunities.

Manufactured Home Communities

Manufactured housing presents the most acute insurance challenges—and potentially the greatest opportunity for innovation. The chattel vs. real property distinction that governs most manufactured homes limits financing options and excludes residents from standard homeowners insurance markets. Older units, classified as personal property like vehicles, often cannot obtain coverage at any price. Even residents who can find coverage face premiums that may exceed 5% of the home’s value annually—unsustainable for households on fixed incomes.

A promising approach focuses on park infrastructure rather than individual units. Roads, utilities, drainage systems, and common facilities represent shared community assets whose protection benefits all residents regardless of individual unit insurance status. An embedded insurance product covering park infrastructure could be funded through lot rent, creating baseline protection for the community’s viability while individual residents retain the option to insure their own units. For resident-owned cooperatives, this infrastructure-first approach aligns naturally with cooperative governance and shared responsibility.

Deed-Restricted Affordable Ownership

Community Land Trusts and inclusionary housing programs create permanently affordable homeownership through deed restrictions that limit resale prices. These restrictions ensure affordability across generations but create a financing gap when insurance costs spike. Unlike market-rate homeowners who can (in theory) absorb higher premiums or sell and relocate, CLT homeowners face constrained equity that limits their capacity to respond to insurance market changes.

The deed restriction mechanism itself provides an embedding opportunity: insurance requirements can be written into deed covenants, with coverage embedded into CLT stewardship fees. The CLT’s ongoing relationship with homeowners—including requirements for financial counseling and stewardship—creates natural touchpoints for insurance education and enrollment.

Nonprofit Affordable Rental Portfolios

Housing authorities and CDCs managing affordable rental portfolios face a different but related challenge: rising insurance costs threaten operating budgets and, ultimately, the financial viability of affordable housing development. When property insurance consumes an increasing share of operating revenue, less remains for maintenance, services, and reserves—degrading housing quality and long-term sustainability.

Portfolio-level risk pooling offers efficiency gains unavailable to individual properties. A regional affordable housing insurance collaborative—potentially structured as a risk retention group or captive—could aggregate multiple nonprofit portfolios, achieve scale for better reinsurance access, and retain underwriting profits within the mission-driven sector.

Applying the Total Cost of Risk Framework

A Total Cost of Risk approach enables comprehensive analysis of what communities actually pay for risk—not just insurance premiums, but the full spectrum of costs associated with hazard exposure. For affordable housing, TCOR analysis reveals the hidden subsidies currently embedded in the system and identifies opportunities for more efficient, equitable risk financing.

TCOR Components for Affordable Housing

1. Direct Insurance Costs: Premiums paid for property, liability, and flood coverage; coverage gaps and exclusions; deductibles and self-insured retentions.

2. Retained/Uninsured Losses: Damage to uninsured structures; contents losses (particularly acute for manufactured housing residents); costs exceeding policy limits.

3. Indirect Economic Costs: Resident displacement and relocation expenses; lost rental income during repairs; neighborhood destabilization effects; workforce disruption.

4. Administrative & Prevention Costs: Risk assessment and management; resilience investments; program administration.

5. Systemic Municipal Costs: Emergency shelter and services; property tax revenue loss; housing voucher costs when units are permanently lost.

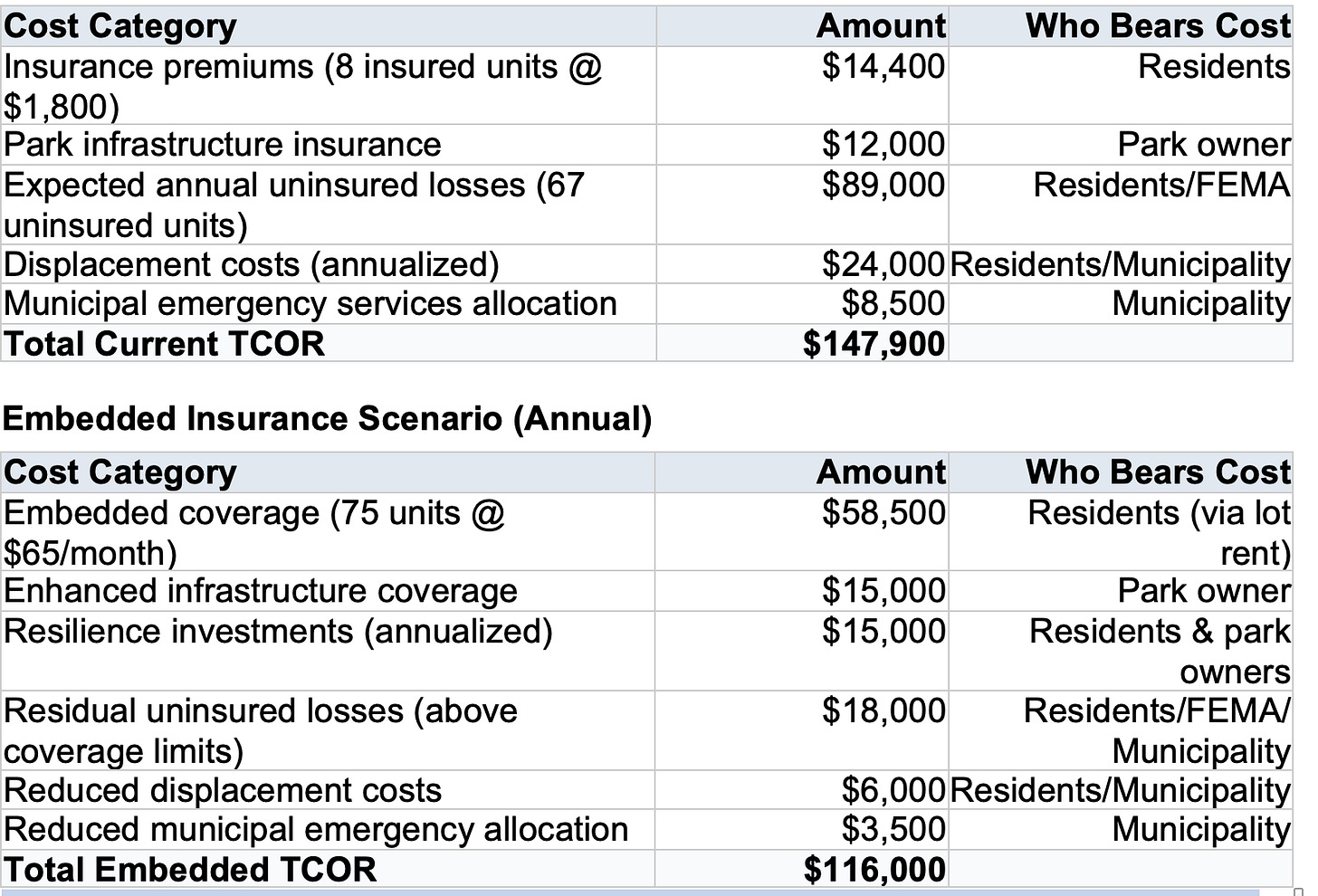

Illustrative TCOR Calculation

Consider a hypothetical 75-unit manufactured home community scenario with moderate flood exposure. The following illustrates how TCOR analysis might reveal the true costs currently distributed across stakeholders.

In this illustrative scenario, embedded insurance reduces combined with resilience investments total community-wide costs by approximately $31,000 annually (21%) while universalizing baseline protection. The key insight is not just potential for cost reduction, but cost reallocation—shifting expenses from unpredictable, catastrophic uninsured losses to predictable, manageable premium payments embedded in monthly housing costs.

Sustainable risk financing requires an integrated approach that finances pre-loss investments into resilience and concurrently closes protection gaps while capturing the value of risk reduction in post loss risk financing such as insurance. Prerequisites for creating a sustainable risk financing approach includes 1) knowing the current cost of risk and 2) know where/who it lands on which requires knowing the protection gap locally.

Pilot Implementation Pathway

A phased approach allows stakeholders to build capacity, test assumptions, and refine the model before broader deployment.

Phase 1: Assessment & Convening (Months 1-4)

1. Catalog affordable housing portfolio across target pilot area (housing authorities, CDCs, manufactured home communities)

2. Conduct baseline TCOR analysis for representative properties in each typology

3. Convene stakeholder working group to define priorities and governance structure

4. Engage MassHousing/DHCD to explore alignment with state housing preservation priorities

Phase 2: Product Development Partnership (Months 5-9)

5. Issue RFP or proactively engage with MGA partner(s) willing to co-develop embedded products

6. Design coverage structures tailored to each housing typology

7. Develop embedding mechanisms (lease addenda, lot rent modifications, stewardship fee structures)

8. Establish performance metrics and evaluation framework

Phase 3: Pilot Launch (Months 10-18)

9. Select initial participant properties (recommend: 1 manufactured home community + 1 rental portfolio)

10. Implement embedded coverage with resident communication and enrollment

11. Monitor claims experience, resident satisfaction, and operational efficiency

12. Document lessons learned for refinement and replication

Phase 4: Evaluation & Scaling (Months 19-24)

13. Conduct comprehensive TCOR comparison (baseline vs. embedded)

14. Refine product design and operational procedures based on pilot experience

15. Develop replication toolkit for other regions

16. Expand to additional properties and potential adjacent counties

Desired Outcomes

For Vulnerable Populations

• Baseline catastrophe protection regardless of individual purchasing capacity

• Rapid recovery support that prevents displacement

• Transparent, understandable coverage terms

For Housing Providers

• Sustainable insurance costs that don’t threaten operating budgets

• Portfolio-level coverage that captures risk reduction investments

• Streamlined claims processes that minimize recovery time

For Municipalities

• Protected tax base and housing stock

• Reduced post-disaster response burden

• Demonstrated model for regional collaboration

For Equity

• Explicit targeting of historically underserved communities

• Progressive rate structures or subsidies for lowest-income residents

• Community voice in program design and governance

• Protections against displacement regardless of tenure type

For Insurance Providers

• New markets

• Multiple stakeholders participate in collaborative product development of insurance solutions that meet community needs

• Embedded distribution channels

• Reputation enhancement/restoration with community leaders and consumers who don’t see insurance industry as a partner.

Conclusion: An Invitation to Collaborate

The intersection of affordable housing and insurability presents one of the most pressing—and most under-addressed—challenges facing Massachusetts communities. Plymouth County’s combination of climate exposure, housing needs, and institutional capacity makes it an ideal testing ground for solutions that could scale across the Commonwealth and beyond.

Housing authorities, CDCs, and manufactured home community operators in southeastern Massachusetts are already navigating these challenges daily. The framework presented here offers a pathway from reactive crisis management to proactive, community-centered risk financing—but realizing that pathway requires collaboration among stakeholders who don’t typically work together on insurance questions.

InnSure is actively seeking partners to develop and test this model. We invite housing authorities, municipal planners, affordable housing providers, and manufactured home community operators in Southeastern MA to join the conversation. Together, we can build insurance solutions that protect the residents who need protection most—and demonstrate that insurability planning belongs at the center of affordable housing strategy.

—

Charlie Sidoti is Executive Director of InnSure, a nonprofit innovation hub that partners with municipalities and insurance innovators to develop and test catastrophe insurance solutions. For more information or to explore partnership opportunities, contact info@InnSure.org

Love this Total Cost of Risk framing for affordable housing. The manufactured home comunity angle is especially smart because those residents get completely hammered by both housing and insurance markets. Regional pooling makes way more sense than expecting individual communities to solve this alone, but getting multiple jurisdictions to coordinate is gonna be the tricky part. The $31k annual savings in that scenario is meaningfull but relatively modest compared to the coordination effort required.